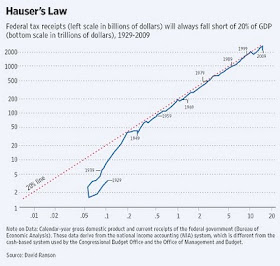

Good to see Hauser's Law getting more attention in today's WSJ. WAY more people need to know about this. I wrote a piece on it called, Some Musings on Taxation," which you can find in the archives from last July. In a nutshell, no matter what tax rates are, the government only collects about 19-20% of GDP in tax revenue. The consistency is remarkable:

It's as if American society has decided collectively that 20% is the right number. Interestingly, when polls ask what percentage people think is fair, 20% is also the most common response.

What this means is that one should lower tax rates, not increase them. But, of course, we are hurtling in the opposite direction...

Comments from finance/tech guy turned novelist. Author of best seller Campusland. Follow on Twitter: @SJohnston60.

Monday, May 17, 2010

Wednesday, May 5, 2010

Two Ways We Don't Want to Be Like Europe (but probably will...)

When I was a private banker in the early 90s, I spent a great deal of time in Switzerland, where I was exposed to the financial ways of Europe. The first thing I noticed was that taxes were a game to most Europeans. Cheating on them was (and is) considered sport, and it was something that seemingly everyone did.

Here in the U.S., cheating on taxes is still considered a shameful thing to do, and compliance runs much higher.

Why the difference? It has to do with people's perception of fairness. If you think your taxes are fair, and are being used in a reasonable way, you are far more likely to comply. If you think the government is stinging you so it can take care of its cronies and contributors, you are much likelier to be angry and not comply. I fear the U.S. is rapidly heading in this direction.

Then there's the issue of charity. Rates of giving are far higher in the U.S. than Europe. Why? For one thing, our tax rates have historically been lower, so we have more to give. But it goes deeper than that. When the government tries to be all things to all people, it crowds out private charity. People think, "Why bother, the government is surely taking care of it - or at least they should be, with all the money they take from me." Europe's cradle-to-grave nanny state has long dissuaded private citizens from solving society's problems. I fear we are also heading in this direction ourselves. Remember orphanages? They were once run by private charities. Now we have government run foster care.

The problem, of course, is that governments have far less incentive to do it right. Bureaucrats are frequently answerable to no one while private charities are answerable to their donors and boards.

Here in the U.S., cheating on taxes is still considered a shameful thing to do, and compliance runs much higher.

Why the difference? It has to do with people's perception of fairness. If you think your taxes are fair, and are being used in a reasonable way, you are far more likely to comply. If you think the government is stinging you so it can take care of its cronies and contributors, you are much likelier to be angry and not comply. I fear the U.S. is rapidly heading in this direction.

Then there's the issue of charity. Rates of giving are far higher in the U.S. than Europe. Why? For one thing, our tax rates have historically been lower, so we have more to give. But it goes deeper than that. When the government tries to be all things to all people, it crowds out private charity. People think, "Why bother, the government is surely taking care of it - or at least they should be, with all the money they take from me." Europe's cradle-to-grave nanny state has long dissuaded private citizens from solving society's problems. I fear we are also heading in this direction ourselves. Remember orphanages? They were once run by private charities. Now we have government run foster care.

The problem, of course, is that governments have far less incentive to do it right. Bureaucrats are frequently answerable to no one while private charities are answerable to their donors and boards.

Monday, May 3, 2010

Banks Are Indeed Hoarding Treasuries

In March in a post called "Something Strange Afoot in Financial Markets," this blog postulated that banks were not lending money and were in fact hoarding treasuries, which is less than ideal for the economy. This was a theory, mind you, but now there's hard evidence from the Fed that it is really happening:

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=ah8D.w3kkWi8

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=ah8D.w3kkWi8