Comments from finance/tech guy turned novelist. Author of best seller Campusland. Follow on Twitter: @SJohnston60.

Wednesday, December 12, 2012

Wall Street Develops Stockholm Syndrome

Barely able to contain its delight today, the New York Times reported that major executives, particularly Wall Street executives, had come around to the "need" for higher taxes.

I seriously doubt a single one of them actually thinks raising taxes is a good idea. But they fear the fiscal cliff more than tax hikes, and they suspect Obama might be more than willing to let us all go over that cliff if the Republicans don't yell "uncle" on rates. Also, if you run a big business these days, particularly in the financial sector, big government is your not-so-silent partner. It works like a protection racquet: don't pay/acquiesce, and you get hurt. Pay up, and your new friend will protect you from unseemly things like competition. Regulation after regulation are raising the bar for entry so high that few newcomers will bother trying anymore. It's true in banking, it's true in conventional money management, and it's true in hedge funds.

Most of these execs know there's a difference between tax rates and tax revenues. They know that raising rates won't bring in anywhere near what the government projects and might even bring in less. They might also know that the rich actually paid a higher percentage of the tax burden after the Bush tax cuts, not before. If they're really on their game, they might even beware of Hauser's Law, which demonstrates that the government only brings in about 19% of GDP in tax revenue no matter where you set rates.

But they must keep their new partner happy, particularly as the latest cudgel, Dodd-Frank, begins to get implemented next year. And they are walking on eggshells - their task master in the White House is not pleased with his Wall Street subjects who largely abandoned him this past election. Examples will be made!

These executives won't actually personally suffer with the higher rates. Once you're worth a certain amount, it doesn't really matter much, so on a purely rational, self-interested basis, their collective kowtow is almost understandable. What they lose in after-tax income will be made up for by what they gain in regulatory advantages and general market stability, or so they think.

They will find themselves wrong. They are helping set up a terrible deal with tax hikes today and budget cuts tomorrow, which, if history is any guide, will never materialize. Debt will overwhelm us, as will market instability.

I wonder how much time will have to pass before we all look back and say, "What the hell could we have been thinking."

Wednesday, November 28, 2012

The SEC Will Take Down SAC Capital

The indictment of Mathew Martomo marks the sixth time a current or former SAC employee has been charged with insider trading. The Feds have had Stevie Cohen, SAC's founder, in their sites for years. This new suit marks the first time Cohen has been directly named, albeit as "Portfolio Manager A."

The Naked Dollar has has written in the past about how insider trading laws are poorly written and there's a lot of gray area. But what of SAC? Is this an unfair government vendetta of some sort?

I don't think so.

The most damning evidence against SAC is, ironically, their track record. Not evidence that you can use in a court, mind you, but common sense evidence that they're not playing by the rules. I have seen their monthly numbers, going back 20 years, and to be blunt, they're not possible. SAC has averaged about a 30% return for 20 years. This, in and of itself, is remarkable, far exceeding the likes of Buffett or Soros. But what most observers miss is what SAC's gross returns have to be to achieve this.

SAC charges the highest fees I've ever encountered: a 3% management fee and a 50% incentive fee. To demonstrate how much these fees slash off the top, let's say they have a 10% year before fees, not bad result. But then subtract 3 points for the management fee and 3.5 points for the incentive fee, and the investor is left with a paltry 3.5% net return. Not so great, although SAC is presumably content because they have pocketed 65% of the return for themselves.

To produce a net return of 30% requires a gross return of...wait for it...63%. While this is not impossible to believe for a single year, or even two, it is wholly unbelievable for twenty. We're talking many standard deviations better than Soros, Buffett, Lynch, or anyone you care to measure against. More damning, they are doing this with billions of dollars, meaning much of their trading activity has to be restricted to highly liquid stocks, which are by their nature more efficient, i.e. less prone to the sort of mispricings that money managers can exploit.

I don't think so.

The most damning evidence against SAC is, ironically, their track record. Not evidence that you can use in a court, mind you, but common sense evidence that they're not playing by the rules. I have seen their monthly numbers, going back 20 years, and to be blunt, they're not possible. SAC has averaged about a 30% return for 20 years. This, in and of itself, is remarkable, far exceeding the likes of Buffett or Soros. But what most observers miss is what SAC's gross returns have to be to achieve this.

SAC charges the highest fees I've ever encountered: a 3% management fee and a 50% incentive fee. To demonstrate how much these fees slash off the top, let's say they have a 10% year before fees, not bad result. But then subtract 3 points for the management fee and 3.5 points for the incentive fee, and the investor is left with a paltry 3.5% net return. Not so great, although SAC is presumably content because they have pocketed 65% of the return for themselves.

To produce a net return of 30% requires a gross return of...wait for it...63%. While this is not impossible to believe for a single year, or even two, it is wholly unbelievable for twenty. We're talking many standard deviations better than Soros, Buffett, Lynch, or anyone you care to measure against. More damning, they are doing this with billions of dollars, meaning much of their trading activity has to be restricted to highly liquid stocks, which are by their nature more efficient, i.e. less prone to the sort of mispricings that money managers can exploit.

Cohen operates his business by lording over dozens of isolated trading groups, each pursuing their own strategies. Make the company money, and you are paid well. Lose money, and you're shown the door pretty quickly. It is speculated that Cohen has insulated himself from potential charges by having plausible deniability about the actions of the individual groups.Yes, they can go after him on something called "failure to supervise," but this is sometimes hard to make stick.

But here's the thing. The trade in question, the one Martomo has been charged with, was massive. The profit alone was $276 million. There's no way Martomo executed a trade of this size without approval from Cohen.

No way.

I hope SAC is innocent, I really do. The hedge fund industry doesn't need this kind of publicity when the vast majority of its players are law abiding citizens. But I don't know how it's possible to legally produce the returns they do, for as long as they do, with as much money as they do. Heck, it would be hard to nail returns like these even with inside information.

And there's this:

It's not illegal to own a big house, of course, and nor is it illegal buy stupid, overpriced art. But the Obama administration has created toxic atmosphere of class envy, bordering on hatred, and sustaining such a zeitgeist requires putting faces on your enemies. Guilty or innocent, Stevie Cohen makes for a very compelling villain.

This is why, one way or another, the feds will bring Cohen down. They may get a conviction, they may not, but no matter. Death of a thousand subpoenas is still death. Investors will bail. Personally, I can't believe they haven't already, but I guess 30% is hard to walk away from.

But here's the thing. The trade in question, the one Martomo has been charged with, was massive. The profit alone was $276 million. There's no way Martomo executed a trade of this size without approval from Cohen.

No way.

I hope SAC is innocent, I really do. The hedge fund industry doesn't need this kind of publicity when the vast majority of its players are law abiding citizens. But I don't know how it's possible to legally produce the returns they do, for as long as they do, with as much money as they do. Heck, it would be hard to nail returns like these even with inside information.

And there's this:

The Cohen Spread, Greenwich

And this...

A $12 Million Stuffed Shark

It's not illegal to own a big house, of course, and nor is it illegal buy stupid, overpriced art. But the Obama administration has created toxic atmosphere of class envy, bordering on hatred, and sustaining such a zeitgeist requires putting faces on your enemies. Guilty or innocent, Stevie Cohen makes for a very compelling villain.

This is why, one way or another, the feds will bring Cohen down. They may get a conviction, they may not, but no matter. Death of a thousand subpoenas is still death. Investors will bail. Personally, I can't believe they haven't already, but I guess 30% is hard to walk away from.

Tuesday, November 27, 2012

Three Realities

The following is a fabulous post, reprinted with permission from a recommended blog called BeeLine (http://beelineblogger.blogspot.com).

Three Charts to Start Your Week

I came across three charts this weekend that I think are worth sharing because they pass all the tests above.

The first chart shows the control of state capitals since 1938. The red represents the number of states where both houses of the state legislature and the governor were controlled by the Republicans. The blue represents where the same is true for the Democrats. Gray indicates where there is some type of shared control in the state.

|

| Source: National Conference of State Legislatures as reported in The New York Times |

Notice that it has been 50 years since the Republicans controlled so many states. There has also never been a period since 1938 when the Republicans made more gains in state government than in the years since Barack Obama became President. This does not look like a political party that is having difficulties in connecting its message with a changing demographic.

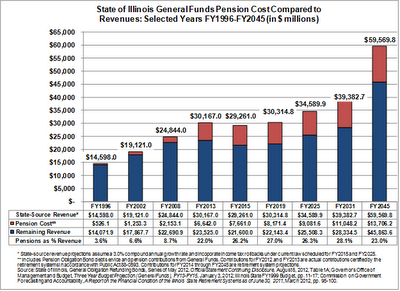

The second chart I came across involves the disastrous state of the public pension costs facing the state of Illinois. Illinois is a state that has been controlled exclusively by Democrats in its state house since 1982 except for one two-year Republicans majority in the mid-1990's. Democrats have controlled both houses of the legislature and the governorship since 2003. This shows what happens when a political party is owned by the public sector unions.

The share of total revenue the state collects that must be used for annual pension costs has risen from 3.6% in 1996 to 22.0% in 2013. It is headed for nearly $3 dollars for every $10 in revenue by the end of this decade.

|

| Source: Institute for Illinois' Fiscal Sustainability |

There is no question in my mind that Illinois is headed for bankruptcy. They seem to have gone beyond the point of no return. Remember, this is a state that increased individual income tax rates across the board by 66% (from 3% to 5%) and corporate tax rates by 45% last year. How high do taxes need to go to fill this hole? There will be few taxpayers left who will want to pay that bill.

The third chart deals with CO2 emissions. Remember the Kyoto Protocol in 1997 that the liberals argued was absolutely critical for the United States to adopt to save the planet? Of course, 70% of the world (including China and India) were exempt from the treaty. The U.S. Senate voted against Kyoto 95-0 in 1997. However, this is another issue that many on the Left still like to blame on George W. Bush as he refused to endorse adoption of Kyoto in his Administration. Of course, the Senate during the Clinton-Gore administration made it clear that the United States would not sign Kyoto if it excluded China, India and other countries. The Bush position was identical to the Senate position in 1997 but why let a little fact like that get in the way? How has carbon emissions growth worked out since that time?

Notice that China's emissions have almost tripled since 1997. India's have doubled. Carbon emissions in the United States are lower today than they were in 1997. China is now emitting about 50% more carbon emissions than the United States.

I found it interesting in researching this subject that last December Canada pulled out of the Kyoto Protocol that it had agreed to in 1997. It did so to save an estimated $14 billion in penalties. In making the announcement the Environment Minister of Canada blamed an "incompetent Liberal government who signed the accord but took little action to make the necessary greenhouse emissions cuts".

Who was right on Kyoto? What exactly has it accomplished compared to what it was supposed to accomplish? It looks to be nothing if the goal was to reduce worldwide carbon emissions. Of course, that was not the real goal anyway. The real goal was to attempt to soak the rich (the United States) with enormous financial penalties which is a favorite past time of the far left. Why are facts like these so often swept under the rug by the liberal media?

|

| Credit: Watt's Up With That |

Monday, November 26, 2012

The CFTC Is Suing Intrade

SERIOUSLY, they should find something useful to do with their time.

http://www.businessinsider.com/the-cftc-is-suing-intrade-2012-11

Here's hoping Intrade prevails.

http://www.businessinsider.com/the-cftc-is-suing-intrade-2012-11

Here's hoping Intrade prevails.

Thursday, November 15, 2012

Why Certain People's Sex Lives Are Our Business

During the Monica Lewinsky scandal, the cultural left brayed that Bill Clinton's sex life was none of our business. The same crowd tried to make this argument about Anthony Weiner, but Weiner couldn't survive pornface. Lately, they seem to have changed their tune where David Petraeus is concerned. (The political calculus is different, and the left is nothing if not an utterly political animal.)

But what should the bedroom standard for politicians and high government officials be? Some might make an entirely moral argument that holds the political class to the highest standard. After all, as leaders, they should set an example for our children. Well, the upper West Side precincts don't particularly care for moral standards, so this argument won't impress them. But is there another, more practical reason to give a damn?

Allow me to suggest that there are reasons to hold most officials to a very high standard. First, there is national security to consider. If you are in a position where you have access to classified information, you shouldn't be fooling around for the obvious reason that you can be blackmailed. The honey trap is the oldest espionage trick in the book.

On this basis, it is fair to ask the president, his top advisors, the Joint Chiefs, members of the House and Senate Intelligence Committees, and senior officials at the NSA and CIA to all keep it in their pants for the greater good.

But there are broader issues, and it's not just national security that we need to consider. Basically, if someone has the power to make important decisions or affect policy, they, too, can be compromised. What if someone on the Judiciary Committee was blackmailed into voting a certain way on a Supreme Court justice? Obamacare passed by a single vote - what if someone was quietly coerced?

Ponder, also, how much easier this is to pull off in today's digital world than it once was. Heck, the "honey" doesn't even need to have actual sex with the target if they can just get something damning in an email, a text, a tweet, or a Facebook post. Once the "send" button is hit, all control is lost.

I'll go one step further: there doesn't even need to be a "honey." It can be a creepy operative sitting at a computer. Here's how you'd do it:

- Find a picture of a random hot babe on the internet.

- Create a fake Facebook or Twitter account using the picture of the girl.

- Start friending or following politicians and flirting with them online.

- Steer the flirtation in a sexual direction (assuming the pol doesn't do it first).

- Inform the politician that he will vote a certain way on a crucial bill or he will be exposed and his career ended.

(Parenthetically, you would think Petraeus, as head of the CIA, would have some pretty cool covert techniques at his disposal to keep an affair quiet...or not, since he communicated with his paramour through GMAIL! Yikes.)

I would like to suggest, as I have before, that we have actually had a significant case of sexual blackmail in our country's history. How else to explain how this man...

...didn't fire this one...

The Kennedys hated J. Edgar Hoover. Bobby, in particular, had strong feelings, and running the Justice Department, he was forced to work closely with Hoover. Hoover had actively supported Nixon in 1960 and was arguably a tyrant, having run the FBI as his personal fiefdom since its founding. Why didn't JFK simply fire him?

The answer is one of two things. The first possibility is that Hoover, undoubtedly possessing evidence of JFK's and RFK's varied affairs, was blackmailing the administration. The second is that the Kennedys simply feared that Hoover had the goods. Either way, America had to live under an unchecked, tyrannical FBI director for longer than it should have, all because the Kennedys couldn't keep it in their pants.

There you have it, an actual real life example of why the personal behavior of politicians matters.

Don't get me wrong, I think character matters, too, and there are plenty of politicians who manage to keep to the straight and narrow. But those of a more libertine bent don't put much stock in this argument. Fine, that's their prerogative. But I can only assume that they don't think extortion is a desirable course of events. Extortion is not a moral position that one is for or against, it's just a dangerous potential subversion of the democratic process.

Here's to hoping we can start holding our leaders to a higher standard.

Monday, November 12, 2012

America: Who Pays the Bills?

I remember a couple of years ago, Michelle Obama urge an assembled crowd of adoring college students not to "sell out" by working at a private company. She wanted them to do things like work at non-profits. Gee, I thought, what if they all took her advice? Who the heck would pay the bills?

This got me wondering: how many people, do you suppose, are actually supporting this country? By that, I mean how many people are actually producing the wealth on which everyone relies, in one form or another? I didn't know, so I decided to find out.

Most jobs "pay for" themselves because they produce definable excess wealth. For instance, a factory owner will pay x to a worker because the value of person's work is worth more than x (this is also known as surplus value, a concept that Marx found contemptible). These are jobs that produce wealth. No one must contribute to that worker's salary out of the goodness of their hearts, or through taxation.

Other professions, such as government workers, teachers, clergy, foundation professionals, etc., rely money that must be taken from others via taxation or persuaded from others via charity.

So, how many people are footing the bill?

Our starting point is the number of employed people in the U.S.:

154 million

From this, we subtract

State and local government workers (incl. teachers) - 16 million

Federal workers - 4.4 million

Non-profit health care workers - 5.7 million

Higher Ed professionals - 3 million

Clergy and other religion professionals - 1.6 million

Civic, social , and fraternal organizations - 0.5 million

Arts and culture foundations - 0.35 million

Total: 31.6 million

This is the number of people who have jobs, but whose jobs must be funded through taxation or charity. Subtracting this from 154 million, we get 122.4 million as the number of workers who are producing wealth.

But there are lots of other people, too, principally the young, the old, the sick, and the unemployed. These groups do not produce wealth and must also, in all or in part, rely on funds from others.

The population of the United States is 311 million. There are 122 million people keeping the ship afloat. Also ponder this: for every three working age Americans with a job there are two without. I would suggest these things are unsustainable all by themselves, but it's only going to get worse. Ten thousand baby boomers retire each and every day.

I will sum up the Obama administration's approach to this for the next four years: "Nothing to see here. Move along."

(Note: this piece is not meant to suggest that professions such as teaching provide no value, of course they do. I taught myself, and I'd like to think I wasn't wasting my time. It is simply meant to point out some very harsh economic realities. My data source was the Bureau of Labor Statistics.)

Friday, November 9, 2012

Election 2012 - Atlas Has Shrugged

The Naked Dollar Electoral Model correctly predicted that Barack Obama would secure re-election. It is now three-for-three.

This is of scant comfort. Sort of like the old joke, second prize is two weeks in Philadelphia. But this is why one creates dispassionate models, because they refuse to factor in emotion. I personally was wrong about the election, primarily because I underestimated turnout in Democrat precincts.

What I also overestimated was any determination on the part of the American people to choose liberty over dependence, and this is a very sad thing. The takers now outnumber the makers.

I tried to read Atlas Shrugged in high school. I think I got through about sixty pages. Atlas is not an easy book. About three years ago, I picked it up again and forced my self to get through it. It gets easier once you get past page sixty, as it turns out.

If you haven't read it, it about a United States in an advancing state of redistributive socialism. The redistribution is as much about crony capitalism as it's about transfer payments to the poor. One by one, the great capitalists - the ones who don't want to play a rigged game - start disappearing. No one knows why or to where. They have decided to go on "strike," having been getting milked dry by a corrupt system that at once despises them and yet needs them to survive. Government actions were justified under the banner of "fairness." After all, the rich didn't get their wealth by honest means. They must have taken it somehow. Others are more deserving.

Any of this sound familiar?

The capitalists decide they won't play the game anymore. The only solution is to withdraw from the very system that they were holding up. The inevitable collapse needed to be hastened, so the country could start anew from the ashes. The capitalist heroes walk away from their factories, implicitly saying to the socialists and bureaucrats, "Here, if you think it's so easy, you try it."

As Margaret Thatcher famously said, "Socialism works only until you run out of other people's money."

Let me tell you what I'm hearing. One very wealthy friend of mine - a truly successful capitalist - told me he is ceasing all venture investing as well as all charitable giving. He is also reorganizing his investments in the most defensive manner possible. Think things like non-dollar cash. Another friend is ceasing all giving to schools. He views - correctly - these gifts as feeding the problem, with schools indoctrinating our kids with the very ideology that makes a Barack Obama possible. (Indeed, a college acquaintance of mine who is now a professor informed me the day after the election, on Facebook, that wealth is not created, it is simply "aggregated." Translation: you didn't make that, you took it.) A charity I know had five six-figure donors last year. All bowed out after the election, fearing significant tax hikes. Hell, let the government solve that problem.

These people I'm talking about are fighters, too, but they seemed to now be resigned to our country's fate. That is profoundly sad and more than a little frightening.

Around 1790, a historian named Alexander Tyler listed the eight phases of democracy:

1. From Bondage to spiritual faith;

2. From spiritual faith to great courage;

3. From courage to liberty;

4. From liberty to abundance;

5. From abundance to complacency;

6. From complacency to apathy;

7. From apathy to dependence;

8. From dependence back into bondage.

Where do you think we are on this list? Arguably, seven. And while eight seems farfetched - come on, this is America! - there is nothing special about our country that makes us immune from the impartial hand of economics. In truth, we have been commiting slow-motion suicide since FDR. Ponder the growth of government spending relative to GDP:

Ignore the spike for wars, because those always scale back quickly. Focus on the baseline growth, because that's what's near impossible to stop as more and more people become addicted to the system. Under Obama, our suicide has hastened itself, the tipping point to insolvency now likely having been reached. (In his bid for re-election, Obama didn't even suggest a solution for any of this. Give the man points for being honest.)

What's so upsetting was that America seems to have collectively decided that this is all okay. The choice was quite a stark one, after all, and certainly no one was abused with the notion that our president was doing a bang-up job on the economy. But that's okay, as long as no one messes with my check. The culture of dependency has now been fully - and willingly - embraced. Gone is the America of rugged individualism. Gone is American exceptionalism, and we will now witness a more persistent decline in our personal liberties. I fear even if we wake up four years from now, there's no turning this ship around. Oh, there will be some sort of economic recovery, but it won't be a great one, and the downward cycle now seems written in stone.

Ironically, I am writing this from Colorado. I say ironically because it is to a small, hidden town in Colorado that all the industrial heroes in Atlas create their capitalist utopia.

Does anyone know where I can find it?

Monday, November 5, 2012

2012 Election Models - The Final Call

First, the electoral prediction. In 2004, this model hit the totals on the head. In 2008, it was really, really, close. To understand how this model is constructed, click here.

The call this year is Obama 281, Romney 257. Here's the time series:

Holy cow, does this look close. One medium size state sways it. May I say, I pray to God the model is wrong this time. On Wednesday, I'll either be pleased for the country or pleased for the model. I'll take country. Personally, I believe Romney will win.

Some better news can be gleaned from our momentum model, where all the late mo belongs to Republicans:

And the cumulative...

(To understand this model, click here.)

Republicans have had a huge surge since the first debate, one that has actually accelerated lately, if quietly. I say "quietly" because it has happened while presidential polling hasn't move a whole lot. But, perhaps, there is an underlying current here. The last surge is the most important. It doesn't guarantee anything, mind you. Gerald Ford had a big late move in 1976 but needed one more day.

We shall see. Buckle up.

The call this year is Obama 281, Romney 257. Here's the time series:

Holy cow, does this look close. One medium size state sways it. May I say, I pray to God the model is wrong this time. On Wednesday, I'll either be pleased for the country or pleased for the model. I'll take country. Personally, I believe Romney will win.

Some better news can be gleaned from our momentum model, where all the late mo belongs to Republicans:

And the cumulative...

(To understand this model, click here.)

Republicans have had a huge surge since the first debate, one that has actually accelerated lately, if quietly. I say "quietly" because it has happened while presidential polling hasn't move a whole lot. But, perhaps, there is an underlying current here. The last surge is the most important. It doesn't guarantee anything, mind you. Gerald Ford had a big late move in 1976 but needed one more day.

We shall see. Buckle up.

Saturday, November 3, 2012

Who Will Show Up on Election Day?

Who will show up to vote? By this, I mean what will the breakdown be between Republicans, Democrats, and Independents? This is the only question that matters right now, because other things are known with a high degree of certainty. We know, for instance, that virtually all partisans will vote for their guy and that independents will split towards Romney by a minimum of +5 but more likely close to +10. All polling confirms this.

So, you tell me who's going to show up on election day, and I'll tell you who's going to win.

HUGE reputational bets on both sides are being made right now on this question. You have mavens like Nate Silver and Sam Wang on the left and Dick Morris and Michael Barone on the right, both agreeing about everything but who will show up.

Take Ohio. A Marist poll released today gives Obama a whopping six-point lead. Time for Mitt to pack it in, right? Not so fast. In 2008, a huge wave election for Dems, the turnout in Ohio was D+5. In 2004, it was R+5. What would you say a reasonable assumption might be for this year? Remember, every poll confirms that Republicans are way more fired up to vote than Democrats. So, what then? D+2 might seem reasonable, maybe even a draw.

Marist's poll has a sample of D+9, almost twice the turnout Dems got in '08. While it is true we just don't know yet, this seems ridiculous on its face. The argument on the other side is that long term demographic changes (i.e. the "browning" of America) are creating an inexorable trend where 2008 was merely a way-station.

This is a difficult argument to buy, given we all know there were vast numbers of people - youth and minorities in particular - that never voted before '08 and won't this time, particularly since they checked the transcendent, history-making box last time.

Nonetheless, polls have definitely tightened in the last couple of days as Obama seems to be enjoying a Sandy-bounce. This is far from a done deal for either side.

Monday, October 29, 2012

Election Models Update

As I write, Sandy is pounding on us, so I will try to get this out before we lose power. During Irene, we lost power for five days. Ugh.

Here's how the pulse index looks:

And the cumulative...

(For an explanation of this, click here.)

It's worth noting there have been three large, definable trends during this campaign. First, a huge upswing for Republicans during the summer, something that went unnoticed by the MSM. This trend was stopped in its tracks by The Democrat convention, which erased fully half the summer's gains for Republicans (this was very much noticed by the MSM.) More recently, there was a Republican uptrend since the first debate. Interestingly, this trend appeared halting at first, but has actually picked up momentum very recently. If Dems can't reverse this soon, they will be very unhappy on election day. Arguably, the most important trend is the last one.

On the other hand, after Romney pulling even a few days ago, Obama has bounced back some in our Electoral College Model, and he now leads 283 to 255:

This is very odd, indeed. Two models, one based on polls, the other based on people making bets, seem to be telling us two different things. More thoughts on this to come.

Here's how the pulse index looks:

And the cumulative...

(For an explanation of this, click here.)

It's worth noting there have been three large, definable trends during this campaign. First, a huge upswing for Republicans during the summer, something that went unnoticed by the MSM. This trend was stopped in its tracks by The Democrat convention, which erased fully half the summer's gains for Republicans (this was very much noticed by the MSM.) More recently, there was a Republican uptrend since the first debate. Interestingly, this trend appeared halting at first, but has actually picked up momentum very recently. If Dems can't reverse this soon, they will be very unhappy on election day. Arguably, the most important trend is the last one.

On the other hand, after Romney pulling even a few days ago, Obama has bounced back some in our Electoral College Model, and he now leads 283 to 255:

This is very odd, indeed. Two models, one based on polls, the other based on people making bets, seem to be telling us two different things. More thoughts on this to come.

SNL Nails It

SNL has summed up the Naked Dollar's view of undecideds nicely:

http://www.nbc.com/saturday-night-live/video/undecided-voter/1418227

http://www.nbc.com/saturday-night-live/video/undecided-voter/1418227

Sunday, October 28, 2012

Have Conservatives Warmed to Mitt?

All through the primaries, conservatives, including this one, kept searching for the anti-Mitt. Just about everyone got to take a cut, and in the end, Romney won a battle of attrition. But consider this: while 30% of the country is Republican, 40% consider themselves to be conservative. This is why Republicans tend to win base-driven elections (Reagan) and lose battles for the center (Ford, Dole, McCain).

Despite the word "extreme" ushering forth from every Democrat talking head, no serious analyst considers Romney to be ideologically conservative. Conservatives themselves certainly don't. And yet, my non-scientific observation is that they have embraced the governor. It would be tempting to say that this is a marriage of convenience, that conservatives would vote for a toaster if it meant dispensing with Obama, but no, I don't that quite covers it. I think there is genuine conservative enthusiasm behind Romney at this point. I feel it myself.

So, why? Is this a case of wishful thinking? It may be, but I think there's something else going on. Mitt Romney is being embraced not as an conservative ideologue, but as a problem solver. His entire background paints a picture not of a thinker but as a doer. Not as someone who views the world as a struggle between ideas, but as a series of problems to be solved.

Romney was a consultant, of course, and then an exceptionally successful private equity executive. Both jobs are about fixing things that are broken. Olympics? Another problem to solve. By all accounts, he even views winning the election as yet another problem to be broken down into component parts and solved. Define the problem, put a plan in place, execute.

Let me be clear that it is always a concern when the non-ideological Republicans are elected president. It gives us Nixons, Fords, and Bush 1s. Ineffective all, and a lack of philosophical bearing was a problem common to each of them. Romney himself had a problematic stint as Massachusetts governor, at least from a conservative perspective (Romneycare!). I'll go a step further and suggest that Romney would have made a poor president if he'd been elected in, say 1996. This is not a man you want for the good times. Left with no major problems, who knows where someone with no compass goes.

But now, the man and the moment might just be a splendid match. America's problems are acute and definable. Romney can see them, and he will attack them like the problem solver he is, and in doing so, will also be aligning himself with conservative economic priorities. I think this explains the new love affair between Romney and his former detractors.

No one planned it this way, but it's a good thing for Mitt it's working out like this. He won't win if conservatives don't show up next week, but show they will.

Wednesday, October 24, 2012

Independents Are Not What You Think They Are

Most independents have no idea what's going on. Okay, that's a controversial thing to say, but bear with me for a couple of minutes. It has something to do with cocktail parties.

Conventional wisdom is that independents control the tipping point of every election. Politicians ignore them at their peril! But who are these folks? It seems to matter, because the media gives us breathless reports on them almost hourly. The message I hear is that they are the thoughtful voters, the ones who carefully weigh every candidate on the issues, and then come down from the mount close to election time, brows furrowed with the weight of all that cogitation, to deliver their verdict.

Conventional wisdom is that independents control the tipping point of every election. Politicians ignore them at their peril! But who are these folks? It seems to matter, because the media gives us breathless reports on them almost hourly. The message I hear is that they are the thoughtful voters, the ones who carefully weigh every candidate on the issues, and then come down from the mount close to election time, brows furrowed with the weight of all that cogitation, to deliver their verdict.

What a pant load.

Before I get into exactly why, let me say there are some smart, informed

independents out there. Many of them have grown weary of one party or

the other and have thrown in the towel, and I am somewhat sympathetic of

this decision. But on the whole, I don’t think they are the enlightened

bunch they are made out to be.

I am on to them.

Here’s

why. Have you ever noticed that when two people sit opposite each

other, they tend to copy each other's postures? One leans back, the

other leans back. One crosses their legs, so does the other, without

conscious thought. This is a well documented phenomenon known among behavioral psychologists as postural mirroring.

The same precise effect happens with preference sets. People tend to gauge the viewpoints and behavior of others around them and modify their own positions accordingly.

Over time, certain viewpoints or behaviors will become acceptable that

weren't previously. Blogger Glenn Reynolds once pointed out, by way of

example, the sudden appearance of American flags across our landscape

(particularly on cars) post-9/11. Were people suddenly more patriotic?

Probably not, but opinions and behavior are highly contagious. Once a

few opinion leaders started waving the flag, others took this as an "all

clear" signal that they could overtly display their patriotism, and

they did. This is sometimes called a "preference cascade."

A

year later, the flags were gone as the process reversed itself.

Investment bubbles and fashion trends come and go in much the same way.

Nowhere is this phenomenon more acute than in the realm of politics and political issues.

The explanation is rooted in the fact that most people don't pay much

attention, but they don't want other people to catch on to this fact. No

one wants to appear uninformed.

This

is where my cocktail party theory comes in.

I know this doesn't

describe anyone reading The Naked Dollar, but let's pretend for a moment that you

are that uninformed person, and you find yourself at a party. Suddenly,

much to your horror, the conversation turns to politics. You very much

don't want to look like an idiot. What to do?

The

answer, short of staying silent, is to take a

position as close as possible to those around you - the cocktail party

center. No one will challenge you if you're agreeing with them. Disagree, however, and you might be forced to back up your opinion with facts or logical argument. That would be risky, especially since you don't know any. So, you gravitate to the views of those around you, and pretty soon you own those views.

This ends up being self-reinforcing: the

more you observe and mimic others, particularly from your own social

milieu, the more you end up truly embracing their opinions, and the more

you, in turn, tend to then influence others.

In

my own hometown, this phenomenon was rampant in the last presidential election

cycle. Probably around 2005, it became unfashionable to voice support

for George Bush. Not our kind, dear. Can’t even pronounce “nuclear.” I

watched as the independents and more than a few Republicans quickly

modified their views to reflect those of progressive opinion leaders, who were pumping up the volume at the same time that conservatives turned mute.

When

Obama came along, the table was already set. Supporting him was "enlightened"

and "sophisticated." Nod your head and watch your social stock rise.

Now, especially in the last few weeks, the process has completely reversed.

Progressives (aka "liberals") are dispirited and conservatives are making the most

noise. The prevailing view is that Obama has been a disappointment. "I

voted for him, but he hasn't lived up to my expectations," is now the

precise cocktail party center. The preference cascade has flipped, and Mitt Romney is the beneficiary. (With two weeks to go before the election, I doubt it can flip again.)

So, with regards to independents, I

don't begrudge the uninformed. Okay, maybe a little. Okay, actually a lot. Some people want to live their lives and not spend hours

figuring out the pros and cons of every issue and candidate. That's

their prerogative. But hey, let's stop pretending they're Stephen Hawking.

Breaking News - Naked Dollar Electoral Model Shows Exact Tie!

After a comfortable lead all year for Obama, the Naked Dollar Electoral Model (NDEM) now shows the race at an exact tie in the electoral college, 269-269. Also, the Intrade Obama contract has plummeted to 56%. Naked Dollar readers should have made a lot of money if they read previous posts about the gross mispricing between the "big" presidential contracts and the state-by-state contracts. Interestingly, this arbitrage still exists because the state contracts (on which our model is based) say it's a 50/50 race, and yet the Obama contract is still at 56%. Look for further adjustment soon. Still a lot of easy money to be made on Intrade this cycle.

(To understand the NDEM, click here.)

Here's an historical view of Obama's contract. Note that the "price" can be interpreted as the odds of winning.

By the way, New York Times and media darling Nate Silver still has the president at a 68% probability of winning. In Silver's defense, he nailed the last election, but he's really out on a limb this time. In 2008, he looked smart because he thought Obama would do better than did just about anyone else, pretty much where he is today. But does he simply have a liberal bias? It's hard to look at the totality of what's going on and conclude that Obama is a 68% favorite right now. Silver is making a HUGE reputational bet.

Let's check in with the Naked Dollar Pulse Index:

And the cumulative...

A lot of volatility lately, mostly favoring Republicans. It remains true that while Romney gains momentum, the same cannot be said for Republican candidates nationwide, at least since the Democrat convention.

(To understand the Pulse Model, click here.)

Monday, October 22, 2012

More Polling Nonsense in Ohio

See, this is what I'm talking about. Today a CBS News/Quinnipiac poll was released for Ohio showing Obama up 50-45. Bad news for Romney, right? Hmm, maybe not. Here's the sample they used:

Republican 26%

Democrat 35%

Independent 34%

Other/DK 5%

CBS outsampled Democrats by 9%. In 2008, Democrats had a 7% turnout advantage in Ohio. Is there anyone on the planet that can make an argument that 2012 turnout will be better for Democrats than 2008?

In 2004, Republicans and Democrats were evenly split. In 2010 it was the same. As I argued previously, you could make the case that this year might be something like D+2. So, what happens to the CBS survey if you adjust it for this assumption? Here's what you get*:

Romney 48%

Obama 47%

Other/DK 5%

With Romney's huge lead among independents, I would argue he might get the lion's share of the "Other/DK" also.

This is some serious polling malpractice, something CBS/Quinnipiac has been guilty of this whole cycle. Here's a prediction: look for their samples to get much more reasonable at the very last minute, because the last poll is the one you're judged by.

A second poll came out today by PPP, a Democrat polling firm, that shows Obama leading Ohio 49-48. Seems reasonable, right? Sure, until you get to the fine print. PPP used a D+8 sample. I'm not the only one squawking about this stuff, and it's easy to dismiss as partisan whining until you lift up the hood and do the analysis for yourself. These pollsters have a lot of 'splainin to do.

*Assumptions: all Republicans vote for Romney, Dems for Obama, independents split +8.5 for Romney, consistent with recent national polling.

Republican 26%

Democrat 35%

Independent 34%

Other/DK 5%

CBS outsampled Democrats by 9%. In 2008, Democrats had a 7% turnout advantage in Ohio. Is there anyone on the planet that can make an argument that 2012 turnout will be better for Democrats than 2008?

In 2004, Republicans and Democrats were evenly split. In 2010 it was the same. As I argued previously, you could make the case that this year might be something like D+2. So, what happens to the CBS survey if you adjust it for this assumption? Here's what you get*:

Romney 48%

Obama 47%

Other/DK 5%

With Romney's huge lead among independents, I would argue he might get the lion's share of the "Other/DK" also.

This is some serious polling malpractice, something CBS/Quinnipiac has been guilty of this whole cycle. Here's a prediction: look for their samples to get much more reasonable at the very last minute, because the last poll is the one you're judged by.

A second poll came out today by PPP, a Democrat polling firm, that shows Obama leading Ohio 49-48. Seems reasonable, right? Sure, until you get to the fine print. PPP used a D+8 sample. I'm not the only one squawking about this stuff, and it's easy to dismiss as partisan whining until you lift up the hood and do the analysis for yourself. These pollsters have a lot of 'splainin to do.

*Assumptions: all Republicans vote for Romney, Dems for Obama, independents split +8.5 for Romney, consistent with recent national polling.

Sunday, October 21, 2012

Election Models Update - October 21st

First, the Pulse Index:

And the cumulative view:

To understand this, click here.

Up is good for Republicans, down for Dems. Quite choppy of late. Interestingly, while Romney's poll numbers have been improving, which tends to push the chart up, this trend has largely been offset by somewhat weakening numbers for Republican Senate and House candidates. On the Senate side, this could have profound implications around Obamacare. We will examine this in more detail in a subsequent post.

Our Electoral College Model shows the race getting incredibly tight, but with a slight edge still in place for Obama:

(To understand this, click here.)

The current score: Obama 276, Romney 262. 270 needed to win. This is the closest the race has been since the numbers began. Interestingly, the "Obama to win" contract on Intrade remains at 61%, despite the state-by-state markets telling a different story (my electoral model relies on data from the state markets). The arbitrage opportunity I alluded to in the last post is still intact.

And the cumulative view:

To understand this, click here.

Up is good for Republicans, down for Dems. Quite choppy of late. Interestingly, while Romney's poll numbers have been improving, which tends to push the chart up, this trend has largely been offset by somewhat weakening numbers for Republican Senate and House candidates. On the Senate side, this could have profound implications around Obamacare. We will examine this in more detail in a subsequent post.

Our Electoral College Model shows the race getting incredibly tight, but with a slight edge still in place for Obama:

(To understand this, click here.)

The current score: Obama 276, Romney 262. 270 needed to win. This is the closest the race has been since the numbers began. Interestingly, the "Obama to win" contract on Intrade remains at 61%, despite the state-by-state markets telling a different story (my electoral model relies on data from the state markets). The arbitrage opportunity I alluded to in the last post is still intact.

Friday, October 19, 2012

Intrade, Ohio, and the State of the Race

This is meant as a follow up to my previous post where I suggested that Obama's odds on Intrade seemed rich relative to the existing poll numbers (it's worth reading first). Yesterday, Obama was trading at a 64% probability for re-election. Today, he's off a bit, at 61.5%. National polls are a dead heat, and swing states are essentially a toss up as well, the one exception being Ohio, where Obama has a slim but definable lead (up 2.4% in the RCP average).

Looking at things on the surface, Obama's lead in Ohio could arguably justify a slight advantage on Intrade, but 64%? This seems illogical. Interestingly, once again, the Buckeye State is shaping up as the state-of-states. It was once thought Romney couldn't win without it, but now, with Virginia, North Carolina, and Florida solidifying for him, it looks like neither candidate can win without it.

Before we delve further into Ohio, let's just step back and make some strong generalizations about this race:

- Democrats, with few exceptions, will vote for Obama

- Republicans, with few exceptions, will vote for Romney

- Independents will divide their vote, but right now are polling Romney +8.2

This last number is an average of the last dozen national polls, and it's a biggie. To put it in perspective, Obama won indies last time by the same amount - there's been a 16 point swing.

So, here's the game: you tell me who's showing up on election day, and I'll tell you who's going to win. If it's precisely the same electorate as four years ago, Obama wins by 2.4%, versus 7.2% in '08. (The change is entirely due to independents). But we all know that's not going to happen. Republicans were dispirited in '08, and Democrats had found their messiah.

What if the electorate is the same as 2010? In this scenario, Romney wins 51-49. But that was an off-year election, and we all know that's not going to happen either.

So, you tell me. Who's going to show? I would argue that the mood of the electorate is closer to 2010 than 2008, and certainly that's what the "intensity" polls say, but that still makes for a tight race. Really, there's no way to look at this thing and see Obama at 61.5%.

When analyzing polls, it's illuminating to see what party breakdown pollsters use. You see, pollsters don't just take all the answers people give and add them up; the data gets demographically massaged. Most importantly, the pollsters make assumptions about what the makeup of the electorate will be. The "electorate" is defined as the people who actually show up to vote. Here are some recent national breakdowns:

Democrat Republican Independent

2010 36% 36% 28%

2008 39 32 29

2004 37 37 26

Even when you look at more elections, 2008 was a total outlier.

Which brings us back to Ohio. If some smart money knew something about Ohio that favored Obama, then the big Obama advantage on Intrade becomes plausible. So let's do a bit of a deep dive in Ohio to see what all the clever traders might know.

Obama won Ohio by 5 points. The breakdown of the electorate was 38-33-29, or D+5. In 2004 it was R+4 and in 2010 it was R+1.

So, what's the right mix for this time? Would you say it's D+5.4? No? Well, that's what the pollsters are using. That's the average of the last seven Ohio polls (hat tip to Numbers Muncher). They are actually assuming that Democrat turnout will be stronger than 2008! There is zero evidence to support this, and it deifies common sense.

A more reasonable assumption might be D+2. If I'm right about this, Romney wins 50.14% of the vote (assuming independents cut his way by the national average of 8.1%). That sure sounds like a toss-up to me. which means that the entire election can viewed the same way. This is not my view, mind you. I think Romney going to win by a surprising margin, and I've been on the record as such for months. But a cold, dispassionate look at the numbers says this thing's a toss-up.

Given this, it appears that the Intrade market is off by 10 points or so. Shorting Obama right now is a great trade. Not necessarily because he's a lock to win, but because the market should merge with the polling data soon. When it gets near parity, unwind, unless you just want to be a punter.

Thursday, October 18, 2012

Is Someone Manipulating Intrade?

As Naked Dollar readers know, I love prediction markets. I love them because they have a highly successful record of predicting political outcomes with greater accuracy than polls. It's real people betting real money. This will be the third presidential election in which I have utilized the Naked Dollar Electoral Prediction Model (see here for explanation), and it has a great track record.

But I have to say, I'm confused right now. The top-line presidential contracts current place Obama's odds for re-election at 64%. I look at the polls, and the RCP average has Obama actually down by about a point nationally. The most recent Gallup poll actually has Romney up by seven points. Shouldn't Romney have a slight edge on Intrade? (Note: Intrade.com is the most popular site for prediction markets.)

Okay, I know what you're going to say next, it's about the electoral college. I know. So what does Intrade have to tell us about the swing states versus the polls? Let's take a look at Romney's numbers for each state:

RCP Avg. Romney Intrade Odds

Colorado +0.8% 50.9%

Florida +2.5% 64.5%

Iowa -2.3% 41.5%

Michigan -4.4% 12.1%

Nevada -3.3% 34.0%

New Hampshire -0.8% 37.5%

North Carolina +4.7% 75.1%

Ohio -2.4% 41.5%

Virginia -0.8% 53.6%

Wisconsin -2.0% 33.5%

Frankly, these numbers don't look that off to me. Maybe I would say Mitt should trade a bit higher in New Hampshire and a bit lower in Virginia, although Virginia probably reflects the fact that the most recent polls show Mitt with the momentum there and there's talk of Obama scaling back in the state.

If you award each state to the Intrade favorite, Obama wins 281-257, a helluva close race. Flip Ohio and Romney wins. Failing that, you could flip two other states such as Wisconsin and New Hampshire. Does all this add up to a 64% chance of winning overall, particularly with national polling numbers trending clearly in Romney's direction? Doesn't seem like it to me. What I'm suggesting here is that there seems to be an arbitrage opportunity between the national presidential contract and the state-by-state ones. Go long Mitt on the big contract and short him in the state contracts.

But why should such an opportunity exist? One possible explanation is that someone is supporting Obama's odds on the national contract because that's the one that everyone looks at. I had a dispirited friend call me last week bemoaning Romney's seemingly long odds. The point is, people look at this, including the media and the Twitterverse.

So, what would it take, hypothetically, if someone wanted to distort the market? There are two contracts that you'd have to manipulate, one for Obama and the other for Romney (they are essentially the inverse of each other). The open interest on these two markets is 2.2 million contracts. This works out to about $11 million in money currently at stake.

There are two ways one needs to look at this: short-term and long-term. To move the market intra-day is no big deal. Right now, for instance, you could bump Obama two percentage points for about $7000. That Intrade has been manipulated in this way is almost certain. On election day 2004, for instance, John Kerry futures shot inexplicably higher. This was, mind you, in the middle of the afternoon when no one knew anything concrete. If I recall, they rose from about 50% to 75%. The move was quickly reversed by traders, but it caused a buzz, which was likely the point. I calculated at the time it required an investment of about $10,000 to move the market that much. Ten grand for some media buzz on election day, when there's no other news? That's got to be the best deal on the planet!

Watch for this to happen again this year. Why? Because in the age of social media, particularly Twitter, it will be an even better deal. #election #obama Holy cow, Obama at 80% on Intrade! Retweet, share, repeat. By the time the contract reverses, the meme will have reverberated through the social graph. Mission accomplished.

Influencing presidential contracts for longer periods of time is a much bigger commitment. Daily dollar volume on each contract is roughly $125,000. What percentage of daily volume would one have to be to keep the price, say, 10% off the true market? For the sake of argument, let's say half the vol would do it. This would require a dollar commitment of roughly $7.5 million over the last 60 days of the campaign.

Remember, though, $7.5 million is the amount you'd have at risk. Should your candidate actually win, you make money on the scheme. For instance, assuming someone is currently manipulating in favor of Obama, there would be a profit of $4.2 million. The correct way to think of the cost is the amount by which you overpaid for the contracts. In this example, we assumed 10%, so the "true" cost is $750,000.

That's starting to sound like a better value, especially in the context of a billion dollar campaign, but the problem is the outcomes are binary, and one would probably have to budget against the worst case. Thus, I doubt is long-term manipulation going on.

What are the implications of this? If I'm right, it either means that:

- Prediction markets are currently mispriced, or

- Prediction market traders know something the polls don't

We will look at these possibilities in my next post.

Friday, October 12, 2012

Election Models Update - October 12th

To understand this model, click here.

We can now see the effect of the first debate in the data:

Republicans are experiencing a pronounced rebound, and while it has only erased about 50% of what Democrats gained post-convention, we don't yet know where the bounce will end. Note that the model's volatility has increased in recent weeks.

Here's the cumulative view:

And here's the electoral college model:

To understand this model click here.

Obama stands at 283 votes (19 fewer than last week), Romney 255 (19 more). 270 are needed to win. The market has moved considerably towards Romney, as I predicted a few weeks ago.

Incidentally, the election model guru everyone seems to love these days is Nate Silver who has a NY Times blog. Nate's at 290 to 248. His model relies on polls whereas we rely on prediction markets, i.e. the wisdom of crowds. Who will win, the crowds or the intellectual? History says the crowds.

We can now see the effect of the first debate in the data:

Republicans are experiencing a pronounced rebound, and while it has only erased about 50% of what Democrats gained post-convention, we don't yet know where the bounce will end. Note that the model's volatility has increased in recent weeks.

Here's the cumulative view:

And here's the electoral college model:

To understand this model click here.

Obama stands at 283 votes (19 fewer than last week), Romney 255 (19 more). 270 are needed to win. The market has moved considerably towards Romney, as I predicted a few weeks ago.

Incidentally, the election model guru everyone seems to love these days is Nate Silver who has a NY Times blog. Nate's at 290 to 248. His model relies on polls whereas we rely on prediction markets, i.e. the wisdom of crowds. Who will win, the crowds or the intellectual? History says the crowds.

Veep Debate - Quick Analysis

The Naked Dollar's call (see previous post) was that both sides would come away thinking their guy won. I gave a slight edge to Ryan. Gotta say, we're 2-for-2. CNN has Ryan edging Biden 48-44.

This surprises me, a bit, because I thought Old Joe won the night. He was completely full of crap, of course, but he played the hand he was dealt well. It was his condescending behavior that cost him the night with viewers. You would think that after Obama's debacle with the split-screen, Biden would have been better prepped on that score, particularly since he was well prepped otherwise. All the smiles, sneers, eye rolls, and interruptions made him seem like a bullying ass on what was otherwise a good night for him.

I personally found this debate irritating to watch, a bit like one of those cable news shows where everyone talks over each other. It was interesting to contrast it with the debate between Joe Lieberman and Dick Cheney in 1999, a favorite of mine. Like last night, the two men sat at a small table, but that's where the similarities end. Cheney and Lieberman were just two smart men having a calm conversation. Both came out looking well.

The burning question is how last night went down with independents. The evidence, so far, is that it made no difference. In Luntz's focus group, no one was swayed. But, all in all, Joe did what he was supposed to do, which was change the national topic from Obama's horrific performance last week.

And on we go.

Thursday, October 11, 2012

Calling the Veep Debate

Not being smart enough to quit while we're ahead after nailing the first debate, the Naked Dollar will take a stab at the Veep debate tonight.

The call: both sides will declare victory, and both will honestly think they've won.

I think it's almost a given that Ryan will perform admirably. While it's true he hasn't formally debated in a while, he has spent the last few years traveling the country, participating in forums, town halls, etc. He's used to being challenged, he doesn't shy away from it, and he knows his facts like nobody's business. Also, he has a likeable, non-threatening, mid-western persona.

Ah, Biden. We all know his shortcomings, the biggest of which is that he weighs in about 40 IQ points shy of Ryan. But I think he makes up for this in sheer political canny. This guy has been around, and he knows how to fire up a room.

After Obama's debate disaster, you can also count on Biden to be really aggressive, and this will be where everyone thinks their guy won. Remember, that as a long-serving member of the Senate Judiciary and Foreign Affairs committees, Biden was a serious attack dog, going after Republican appointees in the nastiest, sleaziest sort of ways. Tonight, this will cause Republicans to recoil in disgust but will be red meat for Chris Matthews groupies. How independents react will be key.

I give Ryan a slight edge, though, on two counts. The first is that Biden has been doing debate prep for six days now. I think we all know that's not Joe. Too many facts just won't fit in there, and it will stifle his natural flourishes. You might say, "Good, he gets in trouble when he's extemporaneous," to which I say, sure, but that's when he's at his best, too. Joe is Joe. Can't wave pixie dust and turn him into someone else in six days.

Secondly, Biden could be the greatest debater on earth and he still couldn't defend the last four years. This is why going nasty is his only option.

Pop some popcorn, grab a beer, and watch the zingers fly.

Monday, October 8, 2012

Conservatives Are from Mars, Liberals from Venus

I recently had two very illuminating experiences, three thousand miles apart.

First, at Yale, a talk given by Gaddis Smith, a prominent retired history professor who has become the unofficial historian for Yale itself. The talk was on the history of Yale's residential college system. For those not familiar, "colleges" are what Yale calls dorms but they are much, much more than just a place to live. Modeled on Oxford and Cambridge, they are the hub of your undergraduate life. Architecturally resplendent, they are a daily beehive of activities that range from sports to arts to social events. Each has its own, distinct personality and it matters which one you are in. It is a wonderful system. (Full disclosure: Gaddis was actually my own master in Pierson College, many moons ago.)

Gaddis's talk was entirely - and I mean entirely - about Yale's history of discrimination, at least as Gaddis saw it. He was viewing the history of the college system through the prism of gender rights, gay rights, etc. Now, Yale's not perfect, but like every other institution in the world, it has evolved. A lot. If your highest priority is the promotion of aggrieved groups, you should be ecstatic with where Yale is today. Over the moon.

But seriously, Gaddis, you couldn't find a single nice thing to say about the college system? Hey, Pierson won the beer chugging tournament when we were both there. How about that? Wooooot!

(Brief time-out...going back to non-sarcasm mode. 1, 2, 3....okay.)

A week later I found myself in Venice Beach, not a tweed jacket in sight. I was looking up a Yale friend that I hadn't seen in 30 years. Great guy, and it had been too long, but we're definitely on other sides of the philosophical fence. He was in the Peace Corps and designs sustainable architecture (Naked Dollar regulars probably know my feelings towards the word "sustainable").

He took me for a coffee shop that also sold surfboards and motorcycles. Piercings abounded. I asked for Splenda and was met with a disapproving glare. (We have agave nectar - it's delicious!)

We got to talking politics, of course. I don't think my friend runs into too many conservatives in the Venice Beach sustainable architecture crowd, because he periodically looked at me like some fascinating new species upon which he had stumbled. That's okay, we conservatives are used to it.

I made this comment: "If Obama is re-elected, the America we grew up with will be gone forever." My friend's face lit up and he said, "Good!"

I was taken aback. Seriously, you actually said that?

But I wanted to understand. This is a nice guy, a decent guy, and smart to boot. I started asking questions, and answers came.

My friend uses the same prism as Gaddis. He was thinking entirely of progress America has made, as he sees it, in areas like women's, gay, and racial rights. Who'd want to go back to the 50s? I, on the other hand, was thinking (almost) entirely of economic issues, and how we will soon bankrupt ourselves. We had two entirely different perspectives, and it was a difficult gap to bridge.

Here's the thing, my liberal friends. None of those issues you care about is going to matter if we become Greece, and that is very much where we are heading. The path, and the mathematics, are clear. When our currency is destroyed and unemployment hits, say, 20%, you will long for the day when we could spend hours at a time debating things like gay marriage. I have serious qualms with your priorities.

Oh, liberals are vaguely aware of these issues, and if you pin them down they'll admit they're a problem. But they just don't care, at least not nearly as much as they do about cultural issues. I would argue this is an adolescent view of the world, one where economic issues are "boring," and best left to others - parents? - to worry about.

Most conservatives I know would give on virtually every social issue if we could just get the country on solid economic footing. Do I care about abortion? Sure, I have a view, but it's about 45th on my list of priorities. As one friend of mine put it, "I'll let them have gay marriage and everything else if we could just have a tax system that makes sense and a goddamned balanced budget."

Amen.

Saturday, October 6, 2012

Election Model Updates - October 6th

Ok, sports fans, I finally found the time to update both models at once. If you want to learn how this is calculated, go here. First, the Pulse Index:

Obviously, this reflects what we know, which is a big momentum shift towards Democrats since the convention. Interesting to note that each bounce for the Dems (downward lines) has been bigger than the previous bounces. He's what the cumulative graph looks like:

While Republicans, overall, are still up since April, Democrats have manged to erase about two-thirds of their gains in just three weeks.

A couple of comments. First, these numbers do not yet reflect any post-debate polls. Check back in a few days to see if Romney's performance resonates up and down the ballots.

Second, you should not interpret this as a "who's going to win" model. It is only meant to measure short-term shifts in the national mood. Just because the Republicans are up, over all, doesn't mean they will do well. It simply means they have done relatively better than Dems, overall, since early April. If their starting point was poor, they could still theoretically get wiped out.

Even a last minute surge by either party isn't a lock, because it might not be enough. 1976 is a good example. Gerry Ford had a huge surge late in the game but fell just short. Had the election been one day later, Ford would have won.

On the other hand, The Naked Dollar Electoral Model is very much intended to predict the winner (of the presidential race only):

If you want to understand this, go here.

Right now, the call is 302 votes for Obama, 236 for Romney. In 2008, it was 365-173. 270 are needed to win. Note that this does include post-debate data, which means the prediction markets aren't as impressed by the debates as everyone else seems to be.

I find this curious, and not a little bit illogical. Is the diffuse, wisdom of the crowds seeing something that we don't see as individuals? Certainly, that's possible. The other possibilty exposes one of the flaws of these markets, which is that they aren't terribly liquid, and so they can be manipulted with a fairly small amount of money. In 2004, for instance, in the early afternoon, there was a huge surge in the John Kerry contract. Remember, on election days, there's basically no information available until later in the day. Did someone know something? Secret exit polls, perhaps?

In reality, the surge made no sense unless someone was trying to create an air of inevitability around a Kerry victory. I figured whomever it was spent about $10,000. A pittance in the scheme of a presidential election.

No, I doubt this is what's going on. I just think the market has been buying into the media narrative that, until a couple of days ago, had Obama winning in a walk. There's some easy money to be made right now on Intrade.

Obviously, this reflects what we know, which is a big momentum shift towards Democrats since the convention. Interesting to note that each bounce for the Dems (downward lines) has been bigger than the previous bounces. He's what the cumulative graph looks like:

While Republicans, overall, are still up since April, Democrats have manged to erase about two-thirds of their gains in just three weeks.

A couple of comments. First, these numbers do not yet reflect any post-debate polls. Check back in a few days to see if Romney's performance resonates up and down the ballots.

Second, you should not interpret this as a "who's going to win" model. It is only meant to measure short-term shifts in the national mood. Just because the Republicans are up, over all, doesn't mean they will do well. It simply means they have done relatively better than Dems, overall, since early April. If their starting point was poor, they could still theoretically get wiped out.

Even a last minute surge by either party isn't a lock, because it might not be enough. 1976 is a good example. Gerry Ford had a huge surge late in the game but fell just short. Had the election been one day later, Ford would have won.

On the other hand, The Naked Dollar Electoral Model is very much intended to predict the winner (of the presidential race only):

If you want to understand this, go here.

Right now, the call is 302 votes for Obama, 236 for Romney. In 2008, it was 365-173. 270 are needed to win. Note that this does include post-debate data, which means the prediction markets aren't as impressed by the debates as everyone else seems to be.

I find this curious, and not a little bit illogical. Is the diffuse, wisdom of the crowds seeing something that we don't see as individuals? Certainly, that's possible. The other possibilty exposes one of the flaws of these markets, which is that they aren't terribly liquid, and so they can be manipulted with a fairly small amount of money. In 2004, for instance, in the early afternoon, there was a huge surge in the John Kerry contract. Remember, on election days, there's basically no information available until later in the day. Did someone know something? Secret exit polls, perhaps?

In reality, the surge made no sense unless someone was trying to create an air of inevitability around a Kerry victory. I figured whomever it was spent about $10,000. A pittance in the scheme of a presidential election.

No, I doubt this is what's going on. I just think the market has been buying into the media narrative that, until a couple of days ago, had Obama winning in a walk. There's some easy money to be made right now on Intrade.

Subscribe to:

Comments (Atom)