Comments from finance/tech guy turned novelist. Author of best seller Campusland. Follow on Twitter: @SJohnston60.

Friday, May 3, 2013

We All Be Wearing Google Glass in Five Years (or Sooner)

Google Glass is something you've probably heard of, but don't really know much about yet. Kind of like the internet in 1994. But they represent the Next Big Step. To what? To the more seamless integration of man and machine, a graying of the boundaries, of man made better by technology.

This is something I have written about here and here.

Think the idea is gimmicky? Think again, and understand what's coming. This is the internet (and then some) right in front of your eyes and in your ears. No need to fish your phone out of your pocket. Robert Scoble, a tech guru, has been trying out a pair for a few weeks, and he says he'll never again be without them. You can read about him here.

What do they do? Well, you can photograph or film anything you're looking at hands free. You can get turn by turn directions. You can ask them anything (voice recognition is built in). You can pull up the internet right in front of your eyes. It appears to hover a couple of feet in front of you, not in your direct line of sight. You can read or send emails and texts. But that's only the beginning.

For a fun video that highlights some of this, click here.

Remember, if you're old enough, back when the Apple II hit the market. It did absolutely nothing useful, but a lot of early adopters bought them anyway. Very quickly, software developers made them, and other PCs, highly useful. Suddenly, it wasn't a case of wanting something, but needing it. You were at a disadvantage without one.

Or how about in the late 90s, when cell phones started gaining popularity? Many resisted, particularly the middle aged and older, thinking it completely unnecessary - annoying, even - to always be "available." Now, there's a societal expectation that you have a phone, and that's because they have become indispensable. Of course, along the way they got "smart" and even more ingrained into everything we do. The App Store is now approaching its 50 millionth download and the iPhone hasn't even been around for six years. Apps were almost an afterthought.

All this will happen with Google Glass (and presumably an Apple competitor). The development community will flock to Glass like Michael Moore to a donut. Tens of thousands of new applications, ones we can't even dream of, will be introduced, and many of them will become integral to our daily lives. Many will do astounding things, like merge what you're seeing with virtual reality. You will be at a disadvantage going about your daily business without your Glass.

Yes, the early adopters will look like geeks, but that won't last long. If the product is priced in the $200-300 range, as is rumored, it will go viral quickly.

Portable, augmented intelligence, currently represented by the smartphone, is effectively becoming our sixth sense because it connects us directly to the entire world, wherever we are. As I've written before, history will someday be divided between the time before this and the time after. Google Glass is the Next Big Step.

P.S. This device will introduce us to a veritable tsunami of privacy issues, but that is a whole other post.

Friday, February 22, 2013

Living in History (Part 2) - Fast Forward

A reader named JPR posted an excellent comment on the last post, so much so that I will expand the conversation here.

He wrote:

Your post raises an interesting question: how will one

distinguish himself from others in the future, or excel in any intellectual

way? You mentioned Jeopardy. Ken

Jennings was the most amazing human contestant ever, but he bowed before his

new master Watson after a solid drubbing.

How does one “get into Harvard” in a world where everyone has Google and

Watson built in?

Some individuals will still be able to stand out based on

physical size, strength, and athleticism.

We realize now that the popular concept from the 1960’s, that we are

going to physically evolve into soft creatures with large heads to hold our

enormous brains, is erroneous. Human

nature will always prize health, athleticism, and physical beauty. There will always be some iteration of

Muhammed Ali or Michael Jordan for people to marvel at. Men and women will be attracted to attractive

mates. Unless we deliberately alter this

trait, I think we know it is hardwired into the human brain.

But it has been Da Vinci and Einstein, Caesar and Churchill, Ford and Jobs who have transformed the world, not Michael Phelps.

But it has been Da Vinci and Einstein, Caesar and Churchill, Ford and Jobs who have transformed the world, not Michael Phelps.

I don’t claim to have an answer. Will it be creativity that cannot be

programmed in? Curiosity? Mental stamina? Competitiveness? Aggression?

There is no doubt we are headed in the direction you

describe. We should embrace it, not

resist it. But the prospect does raise

some primal fears of a sterile, humorless, and/or tyrannical dystopia where

everyone is equal in ability, not just opportunity.

I think the answer is that knowledge isn't everything, it's a tool. It's kind of like when your teacher tells you it's an open-book test. I always knew to be leery because I couldn't ace it by just memorizing a bunch of stuff - all the facts would be accessible to all. It's what you did with the facts that counted.

To me, the future - Google in your head - will be like living an open-book test. Original thought, creativity, humor, not to mention hard work - all these things are still on you. Technology will serve to turbocharge the process.

Wednesday, February 20, 2013

We Are Living in History

I'm sure you've been asked that question: If you could travel back in time, what era would you choose? I've noticed this question has been asked more than once on my company's website, Wayin. Answers vary. The time of Jesus is always popular.

But there's always a concern over how one would "cope" without all the advances we have become used to. Two thousand years ago there were no easy ways to get around or communicate. Everything was labor intensive. You probably had to grow at least some of your own food, and you likely never traveled more than a few miles in your lifetime. Could you cope with that? My guess is you'd look around for a few days, check the box, and then hop back in the time machine. Gotta get a double decaf latte, stat.

Ever ponder how people 500 years from now might answer the same question? I'm guessing their answer would be right now. This- now - is the age when augmented intelligence began, when we all became connected. If you're over the age of, say, 40, you are the last generation to grow up without the internet. Your lifetime will have witnessed the single greatest transition in human history. My 500-years-from-now self wants to meet you.

The funny thing is, those visitors from the future won't want to stick around long, either. To them, connected intelligence will have been integrated into their very biology for centuries, and it will seem to the like we walk around without an additional sense, like being blind. They will be amazed how we possibly coped, especially pre, roughly, 2005, when smartphones became ubiquitous. Augmented intelligence will have made our decedents orders of magnitude smarter.

What is augmented intelligence? Well, how about being able to look up any fact in the world instantly over your smartphone? How about getting directions on-the-fly? How being able to communicate in dozens of ways with anyone, instantly, no matter where you are. I'm sure I don't need to go on. These are examples of what augmented intelligence is today. Buckle your seat belts for what it will mean even a decade from now.

There have really been three technological revolutions, if you think about it, that are the backbone of what I'm talking about. The first was when personal computing became affordable in the 80s. The second was when the internet hit an inflection point as browsers like Netscape became available in the mid-90s. The third was when the internet was freed from our computers and could go with us inside our smartphones. This last one has only happened in the last seven or eight years, and its implications dwarf the the earlier two.

Connectivity is an appendage now. Going outside without a smartphone causes anxiety in anyone under the age of 40. Connectivity is an appendage, and it is evolving from an annoying one that was mostly good for phone calls and emails, to something that is almost necessary to navigate through the world. "Almost" necessary will become "absolutely" necessary very soon. It is hard to believe that "apps" have only been with us for four years.

The smartphone will give way also. Connectivity will become more integrated than something you have to actually carry around in your pocket. Google is working on Google Glasses as we speak. Be prepared to see hipsters everywhere wearing clear glasses around and talking to themselves within a couple of years (followed by the rest of us)...

Bendable computers/smartphones are almost here as well...

Devices will literally be woven into the fabric of our lives. It doesn't stop there, though, because after that, connectivity will be integrated into our neural systems, some believe by around 2030. Google will be in your head. (Think of how you'll kick ass on Jeopardy.) Neural implants are already enabling some amputees control artificial limbs just by thinking about what they want to do.

Think of what it would be like to grow up with both the connectivity and the computational power of computers inside your head. Now imagine that, having lived your whole life with this incredible cognitive power, someone took it away. That's how the pre-millenial world will be viewed by history; a pre-enlightenment, cognitive dark age.

Finally, think how intriguing it would seem to meet people whose lives spanned the transition from one age to the other. That's us, so pay attention! History doesn't always seem remarkable when you're living it, but living it we are.

Monday, January 7, 2013

Tax Policy Enters the Twilight Zone

Reprinted with permission from one of my favorite blogs, Beeline...

At times I think we are living in The Twilight Zone.

For those a little younger than I am, The Twilight Zone was a television series that originally aired from 1959-1964 that combined science fiction, suspense, horror or fantasy which often concluded with a macabre or unexpected twist.

The show started with a voice-over like this which was narrated by the show's creator, Rod Serling.

"This highway leads to the shadowy tip of reality: you're on a through route to the land of the different, the bizarre, the unexplainable...Go as far as you like on this road. Its limits are only those of mind itself. Ladies and Gentlemen, you're entering the wondrous dimension of imagination. Next stop....The Twilight Zone."

If you don't think we have crossed over the line to The Twilight Zone consider this AP story about Gerard Depardieu, the French actor, who recently renounced his birth citizenship because of his anger over the proposal by French President Francois Hollande to raise the income tax on earned income to 75% from the current rate of 41%. In his letter renouncing his citizenship Depardieu stated that he was leaving France because of his belief that success and talent are being punished by the current French government.

Gerard Depardieu

Where is Depardieu going to take up citizenship? Switzerland? Belgium? Austria? UK? USA?

No. This is where we enter The Twilight Zone.

Depardieu is on his way to becoming a Russian citizen as President Vladimir Putin has approved Depardieu's application for citizenship in expedited fashion.

Why would Depardieu be interested in becoming a Russian citizen?

Russia has a flat 13% tax rate. That's right, 13%! France is at 41% and wants to go to 75%. The USA has just increased the income tax rate on rich people like Depardieu to over 40% (including the Obamacare taxes) and communist Russia is at a flat 13%!

This highway has indeed led us to the shadowy tip of reality. We have found we are also on a route to the land of the different, the bizarre, and the unexplainable when a communist country has a flat tax of 13% and what have always been considered free market, capitalistic countries are close to confiscating incomes and property rather than taxing it.

I have to think that if Serling had submitted a Twilight Zone script to CBS in 1962 with a story line that Russia had a flat tax and was luring people of individual talent and achievement away from Western countries it would have been rejected as too far fetched. Not only has Atlas Shrugged but Ayn Rand could return to her homeland and feel good about it.

Please change the channel! All of this is getting a little too scary to watch. Let's watch Leave It To Beaver instead.

At times I think we are living in The Twilight Zone.

For those a little younger than I am, The Twilight Zone was a television series that originally aired from 1959-1964 that combined science fiction, suspense, horror or fantasy which often concluded with a macabre or unexpected twist.

The show started with a voice-over like this which was narrated by the show's creator, Rod Serling.

"This highway leads to the shadowy tip of reality: you're on a through route to the land of the different, the bizarre, the unexplainable...Go as far as you like on this road. Its limits are only those of mind itself. Ladies and Gentlemen, you're entering the wondrous dimension of imagination. Next stop....The Twilight Zone."

If you don't think we have crossed over the line to The Twilight Zone consider this AP story about Gerard Depardieu, the French actor, who recently renounced his birth citizenship because of his anger over the proposal by French President Francois Hollande to raise the income tax on earned income to 75% from the current rate of 41%. In his letter renouncing his citizenship Depardieu stated that he was leaving France because of his belief that success and talent are being punished by the current French government.

Gerard Depardieu

Where is Depardieu going to take up citizenship? Switzerland? Belgium? Austria? UK? USA?

No. This is where we enter The Twilight Zone.

Depardieu is on his way to becoming a Russian citizen as President Vladimir Putin has approved Depardieu's application for citizenship in expedited fashion.

Why would Depardieu be interested in becoming a Russian citizen?

Russia has a flat 13% tax rate. That's right, 13%! France is at 41% and wants to go to 75%. The USA has just increased the income tax rate on rich people like Depardieu to over 40% (including the Obamacare taxes) and communist Russia is at a flat 13%!

This highway has indeed led us to the shadowy tip of reality. We have found we are also on a route to the land of the different, the bizarre, and the unexplainable when a communist country has a flat tax of 13% and what have always been considered free market, capitalistic countries are close to confiscating incomes and property rather than taxing it.

I have to think that if Serling had submitted a Twilight Zone script to CBS in 1962 with a story line that Russia had a flat tax and was luring people of individual talent and achievement away from Western countries it would have been rejected as too far fetched. Not only has Atlas Shrugged but Ayn Rand could return to her homeland and feel good about it.

Please change the channel! All of this is getting a little too scary to watch. Let's watch Leave It To Beaver instead.

Wednesday, December 12, 2012

Wall Street Develops Stockholm Syndrome

Barely able to contain its delight today, the New York Times reported that major executives, particularly Wall Street executives, had come around to the "need" for higher taxes.

I seriously doubt a single one of them actually thinks raising taxes is a good idea. But they fear the fiscal cliff more than tax hikes, and they suspect Obama might be more than willing to let us all go over that cliff if the Republicans don't yell "uncle" on rates. Also, if you run a big business these days, particularly in the financial sector, big government is your not-so-silent partner. It works like a protection racquet: don't pay/acquiesce, and you get hurt. Pay up, and your new friend will protect you from unseemly things like competition. Regulation after regulation are raising the bar for entry so high that few newcomers will bother trying anymore. It's true in banking, it's true in conventional money management, and it's true in hedge funds.

Most of these execs know there's a difference between tax rates and tax revenues. They know that raising rates won't bring in anywhere near what the government projects and might even bring in less. They might also know that the rich actually paid a higher percentage of the tax burden after the Bush tax cuts, not before. If they're really on their game, they might even beware of Hauser's Law, which demonstrates that the government only brings in about 19% of GDP in tax revenue no matter where you set rates.

But they must keep their new partner happy, particularly as the latest cudgel, Dodd-Frank, begins to get implemented next year. And they are walking on eggshells - their task master in the White House is not pleased with his Wall Street subjects who largely abandoned him this past election. Examples will be made!

These executives won't actually personally suffer with the higher rates. Once you're worth a certain amount, it doesn't really matter much, so on a purely rational, self-interested basis, their collective kowtow is almost understandable. What they lose in after-tax income will be made up for by what they gain in regulatory advantages and general market stability, or so they think.

They will find themselves wrong. They are helping set up a terrible deal with tax hikes today and budget cuts tomorrow, which, if history is any guide, will never materialize. Debt will overwhelm us, as will market instability.

I wonder how much time will have to pass before we all look back and say, "What the hell could we have been thinking."

Wednesday, November 28, 2012

The SEC Will Take Down SAC Capital

The indictment of Mathew Martomo marks the sixth time a current or former SAC employee has been charged with insider trading. The Feds have had Stevie Cohen, SAC's founder, in their sites for years. This new suit marks the first time Cohen has been directly named, albeit as "Portfolio Manager A."

The Naked Dollar has has written in the past about how insider trading laws are poorly written and there's a lot of gray area. But what of SAC? Is this an unfair government vendetta of some sort?

I don't think so.

The most damning evidence against SAC is, ironically, their track record. Not evidence that you can use in a court, mind you, but common sense evidence that they're not playing by the rules. I have seen their monthly numbers, going back 20 years, and to be blunt, they're not possible. SAC has averaged about a 30% return for 20 years. This, in and of itself, is remarkable, far exceeding the likes of Buffett or Soros. But what most observers miss is what SAC's gross returns have to be to achieve this.

SAC charges the highest fees I've ever encountered: a 3% management fee and a 50% incentive fee. To demonstrate how much these fees slash off the top, let's say they have a 10% year before fees, not bad result. But then subtract 3 points for the management fee and 3.5 points for the incentive fee, and the investor is left with a paltry 3.5% net return. Not so great, although SAC is presumably content because they have pocketed 65% of the return for themselves.

To produce a net return of 30% requires a gross return of...wait for it...63%. While this is not impossible to believe for a single year, or even two, it is wholly unbelievable for twenty. We're talking many standard deviations better than Soros, Buffett, Lynch, or anyone you care to measure against. More damning, they are doing this with billions of dollars, meaning much of their trading activity has to be restricted to highly liquid stocks, which are by their nature more efficient, i.e. less prone to the sort of mispricings that money managers can exploit.

I don't think so.

The most damning evidence against SAC is, ironically, their track record. Not evidence that you can use in a court, mind you, but common sense evidence that they're not playing by the rules. I have seen their monthly numbers, going back 20 years, and to be blunt, they're not possible. SAC has averaged about a 30% return for 20 years. This, in and of itself, is remarkable, far exceeding the likes of Buffett or Soros. But what most observers miss is what SAC's gross returns have to be to achieve this.

SAC charges the highest fees I've ever encountered: a 3% management fee and a 50% incentive fee. To demonstrate how much these fees slash off the top, let's say they have a 10% year before fees, not bad result. But then subtract 3 points for the management fee and 3.5 points for the incentive fee, and the investor is left with a paltry 3.5% net return. Not so great, although SAC is presumably content because they have pocketed 65% of the return for themselves.

To produce a net return of 30% requires a gross return of...wait for it...63%. While this is not impossible to believe for a single year, or even two, it is wholly unbelievable for twenty. We're talking many standard deviations better than Soros, Buffett, Lynch, or anyone you care to measure against. More damning, they are doing this with billions of dollars, meaning much of their trading activity has to be restricted to highly liquid stocks, which are by their nature more efficient, i.e. less prone to the sort of mispricings that money managers can exploit.

Cohen operates his business by lording over dozens of isolated trading groups, each pursuing their own strategies. Make the company money, and you are paid well. Lose money, and you're shown the door pretty quickly. It is speculated that Cohen has insulated himself from potential charges by having plausible deniability about the actions of the individual groups.Yes, they can go after him on something called "failure to supervise," but this is sometimes hard to make stick.

But here's the thing. The trade in question, the one Martomo has been charged with, was massive. The profit alone was $276 million. There's no way Martomo executed a trade of this size without approval from Cohen.

No way.

I hope SAC is innocent, I really do. The hedge fund industry doesn't need this kind of publicity when the vast majority of its players are law abiding citizens. But I don't know how it's possible to legally produce the returns they do, for as long as they do, with as much money as they do. Heck, it would be hard to nail returns like these even with inside information.

And there's this:

It's not illegal to own a big house, of course, and nor is it illegal buy stupid, overpriced art. But the Obama administration has created toxic atmosphere of class envy, bordering on hatred, and sustaining such a zeitgeist requires putting faces on your enemies. Guilty or innocent, Stevie Cohen makes for a very compelling villain.

This is why, one way or another, the feds will bring Cohen down. They may get a conviction, they may not, but no matter. Death of a thousand subpoenas is still death. Investors will bail. Personally, I can't believe they haven't already, but I guess 30% is hard to walk away from.

But here's the thing. The trade in question, the one Martomo has been charged with, was massive. The profit alone was $276 million. There's no way Martomo executed a trade of this size without approval from Cohen.

No way.

I hope SAC is innocent, I really do. The hedge fund industry doesn't need this kind of publicity when the vast majority of its players are law abiding citizens. But I don't know how it's possible to legally produce the returns they do, for as long as they do, with as much money as they do. Heck, it would be hard to nail returns like these even with inside information.

And there's this:

The Cohen Spread, Greenwich

And this...

A $12 Million Stuffed Shark

It's not illegal to own a big house, of course, and nor is it illegal buy stupid, overpriced art. But the Obama administration has created toxic atmosphere of class envy, bordering on hatred, and sustaining such a zeitgeist requires putting faces on your enemies. Guilty or innocent, Stevie Cohen makes for a very compelling villain.

This is why, one way or another, the feds will bring Cohen down. They may get a conviction, they may not, but no matter. Death of a thousand subpoenas is still death. Investors will bail. Personally, I can't believe they haven't already, but I guess 30% is hard to walk away from.

Tuesday, November 27, 2012

Three Realities

The following is a fabulous post, reprinted with permission from a recommended blog called BeeLine (http://beelineblogger.blogspot.com).

Three Charts to Start Your Week

I came across three charts this weekend that I think are worth sharing because they pass all the tests above.

The first chart shows the control of state capitals since 1938. The red represents the number of states where both houses of the state legislature and the governor were controlled by the Republicans. The blue represents where the same is true for the Democrats. Gray indicates where there is some type of shared control in the state.

|

| Source: National Conference of State Legislatures as reported in The New York Times |

Notice that it has been 50 years since the Republicans controlled so many states. There has also never been a period since 1938 when the Republicans made more gains in state government than in the years since Barack Obama became President. This does not look like a political party that is having difficulties in connecting its message with a changing demographic.

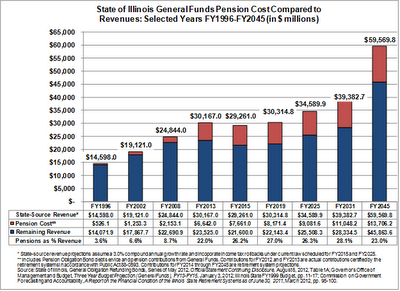

The second chart I came across involves the disastrous state of the public pension costs facing the state of Illinois. Illinois is a state that has been controlled exclusively by Democrats in its state house since 1982 except for one two-year Republicans majority in the mid-1990's. Democrats have controlled both houses of the legislature and the governorship since 2003. This shows what happens when a political party is owned by the public sector unions.

The share of total revenue the state collects that must be used for annual pension costs has risen from 3.6% in 1996 to 22.0% in 2013. It is headed for nearly $3 dollars for every $10 in revenue by the end of this decade.

|

| Source: Institute for Illinois' Fiscal Sustainability |

There is no question in my mind that Illinois is headed for bankruptcy. They seem to have gone beyond the point of no return. Remember, this is a state that increased individual income tax rates across the board by 66% (from 3% to 5%) and corporate tax rates by 45% last year. How high do taxes need to go to fill this hole? There will be few taxpayers left who will want to pay that bill.

The third chart deals with CO2 emissions. Remember the Kyoto Protocol in 1997 that the liberals argued was absolutely critical for the United States to adopt to save the planet? Of course, 70% of the world (including China and India) were exempt from the treaty. The U.S. Senate voted against Kyoto 95-0 in 1997. However, this is another issue that many on the Left still like to blame on George W. Bush as he refused to endorse adoption of Kyoto in his Administration. Of course, the Senate during the Clinton-Gore administration made it clear that the United States would not sign Kyoto if it excluded China, India and other countries. The Bush position was identical to the Senate position in 1997 but why let a little fact like that get in the way? How has carbon emissions growth worked out since that time?

Notice that China's emissions have almost tripled since 1997. India's have doubled. Carbon emissions in the United States are lower today than they were in 1997. China is now emitting about 50% more carbon emissions than the United States.

I found it interesting in researching this subject that last December Canada pulled out of the Kyoto Protocol that it had agreed to in 1997. It did so to save an estimated $14 billion in penalties. In making the announcement the Environment Minister of Canada blamed an "incompetent Liberal government who signed the accord but took little action to make the necessary greenhouse emissions cuts".

Who was right on Kyoto? What exactly has it accomplished compared to what it was supposed to accomplish? It looks to be nothing if the goal was to reduce worldwide carbon emissions. Of course, that was not the real goal anyway. The real goal was to attempt to soak the rich (the United States) with enormous financial penalties which is a favorite past time of the far left. Why are facts like these so often swept under the rug by the liberal media?

|

| Credit: Watt's Up With That |

Monday, November 26, 2012

The CFTC Is Suing Intrade

SERIOUSLY, they should find something useful to do with their time.

http://www.businessinsider.com/the-cftc-is-suing-intrade-2012-11

Here's hoping Intrade prevails.

http://www.businessinsider.com/the-cftc-is-suing-intrade-2012-11

Here's hoping Intrade prevails.

Thursday, November 15, 2012

Why Certain People's Sex Lives Are Our Business

During the Monica Lewinsky scandal, the cultural left brayed that Bill Clinton's sex life was none of our business. The same crowd tried to make this argument about Anthony Weiner, but Weiner couldn't survive pornface. Lately, they seem to have changed their tune where David Petraeus is concerned. (The political calculus is different, and the left is nothing if not an utterly political animal.)

But what should the bedroom standard for politicians and high government officials be? Some might make an entirely moral argument that holds the political class to the highest standard. After all, as leaders, they should set an example for our children. Well, the upper West Side precincts don't particularly care for moral standards, so this argument won't impress them. But is there another, more practical reason to give a damn?

Allow me to suggest that there are reasons to hold most officials to a very high standard. First, there is national security to consider. If you are in a position where you have access to classified information, you shouldn't be fooling around for the obvious reason that you can be blackmailed. The honey trap is the oldest espionage trick in the book.

On this basis, it is fair to ask the president, his top advisors, the Joint Chiefs, members of the House and Senate Intelligence Committees, and senior officials at the NSA and CIA to all keep it in their pants for the greater good.

But there are broader issues, and it's not just national security that we need to consider. Basically, if someone has the power to make important decisions or affect policy, they, too, can be compromised. What if someone on the Judiciary Committee was blackmailed into voting a certain way on a Supreme Court justice? Obamacare passed by a single vote - what if someone was quietly coerced?

Ponder, also, how much easier this is to pull off in today's digital world than it once was. Heck, the "honey" doesn't even need to have actual sex with the target if they can just get something damning in an email, a text, a tweet, or a Facebook post. Once the "send" button is hit, all control is lost.

I'll go one step further: there doesn't even need to be a "honey." It can be a creepy operative sitting at a computer. Here's how you'd do it:

- Find a picture of a random hot babe on the internet.

- Create a fake Facebook or Twitter account using the picture of the girl.

- Start friending or following politicians and flirting with them online.

- Steer the flirtation in a sexual direction (assuming the pol doesn't do it first).

- Inform the politician that he will vote a certain way on a crucial bill or he will be exposed and his career ended.

(Parenthetically, you would think Petraeus, as head of the CIA, would have some pretty cool covert techniques at his disposal to keep an affair quiet...or not, since he communicated with his paramour through GMAIL! Yikes.)

I would like to suggest, as I have before, that we have actually had a significant case of sexual blackmail in our country's history. How else to explain how this man...

...didn't fire this one...

The Kennedys hated J. Edgar Hoover. Bobby, in particular, had strong feelings, and running the Justice Department, he was forced to work closely with Hoover. Hoover had actively supported Nixon in 1960 and was arguably a tyrant, having run the FBI as his personal fiefdom since its founding. Why didn't JFK simply fire him?

The answer is one of two things. The first possibility is that Hoover, undoubtedly possessing evidence of JFK's and RFK's varied affairs, was blackmailing the administration. The second is that the Kennedys simply feared that Hoover had the goods. Either way, America had to live under an unchecked, tyrannical FBI director for longer than it should have, all because the Kennedys couldn't keep it in their pants.

There you have it, an actual real life example of why the personal behavior of politicians matters.

Don't get me wrong, I think character matters, too, and there are plenty of politicians who manage to keep to the straight and narrow. But those of a more libertine bent don't put much stock in this argument. Fine, that's their prerogative. But I can only assume that they don't think extortion is a desirable course of events. Extortion is not a moral position that one is for or against, it's just a dangerous potential subversion of the democratic process.

Here's to hoping we can start holding our leaders to a higher standard.

Monday, November 12, 2012

America: Who Pays the Bills?

I remember a couple of years ago, Michelle Obama urge an assembled crowd of adoring college students not to "sell out" by working at a private company. She wanted them to do things like work at non-profits. Gee, I thought, what if they all took her advice? Who the heck would pay the bills?

This got me wondering: how many people, do you suppose, are actually supporting this country? By that, I mean how many people are actually producing the wealth on which everyone relies, in one form or another? I didn't know, so I decided to find out.

Most jobs "pay for" themselves because they produce definable excess wealth. For instance, a factory owner will pay x to a worker because the value of person's work is worth more than x (this is also known as surplus value, a concept that Marx found contemptible). These are jobs that produce wealth. No one must contribute to that worker's salary out of the goodness of their hearts, or through taxation.

Other professions, such as government workers, teachers, clergy, foundation professionals, etc., rely money that must be taken from others via taxation or persuaded from others via charity.

So, how many people are footing the bill?

Our starting point is the number of employed people in the U.S.:

154 million

From this, we subtract

State and local government workers (incl. teachers) - 16 million

Federal workers - 4.4 million

Non-profit health care workers - 5.7 million

Higher Ed professionals - 3 million

Clergy and other religion professionals - 1.6 million

Civic, social , and fraternal organizations - 0.5 million

Arts and culture foundations - 0.35 million

Total: 31.6 million

This is the number of people who have jobs, but whose jobs must be funded through taxation or charity. Subtracting this from 154 million, we get 122.4 million as the number of workers who are producing wealth.

But there are lots of other people, too, principally the young, the old, the sick, and the unemployed. These groups do not produce wealth and must also, in all or in part, rely on funds from others.

The population of the United States is 311 million. There are 122 million people keeping the ship afloat. Also ponder this: for every three working age Americans with a job there are two without. I would suggest these things are unsustainable all by themselves, but it's only going to get worse. Ten thousand baby boomers retire each and every day.

I will sum up the Obama administration's approach to this for the next four years: "Nothing to see here. Move along."

(Note: this piece is not meant to suggest that professions such as teaching provide no value, of course they do. I taught myself, and I'd like to think I wasn't wasting my time. It is simply meant to point out some very harsh economic realities. My data source was the Bureau of Labor Statistics.)

Subscribe to:

Posts (Atom)